Demystifying Mortgages: A Deep Dive into How Mortgages Work

Mortgages are a fundamental aspect of the real estate world. They enable countless individuals and families to achieve the dream of homeownership. Yet, understanding how mortgages work can be a daunting task. I want to break down the pieces of a mortgage to help you better understand this large debt.

What is a mortgage?

In simple terms, a mortgage is a loan provided by a lender, typically a bank or a mortgage company, to help you purchase a home. Rather than paying the full price of the house upfront, you pay a portion (the down payment) and borrow the rest from the lender. The borrowed amount (also known as principal), plus interest, is then repaid over an extended period (also known as the amortization term), in regular installments, commonly referred to as mortgage payments.

Let’s breakdown some of the common terms you will encounter when entering into a mortgage agreement.

Down Payment:

The down payment is the initial amount you pay towards the house’s purchase price. It’s typically a percentage of the total cost, often around 20%. For instance, if you’re buying a $600,000 home, a 20% down payment would amount to $120,000. The amount of down payment you have access to when you purchase a house makes a difference. A larger down payment can lead to a lower mortgage amount, better interest rates, and reduced monthly payments. If you are selling your current home and buying another home, often the amount of equity (the proceeds from the sale of your home less the principal owing on your current mortgage) is used as the downpayment for your new home. This may allow you to not need to come up with any money for a downpayment. Note that if you do not have the 20% downpayment in Canada you may qualify for a CMHC mortgage. This mortgage is a special mortgage that works the same way as a regular mortgage but will have a higher interest rate.

Amortization Term:

The amortization term refers to the number of years over which you’ll repay the mortgage. Common terms are 15, 20, or 30 years, but they can vary. Shorter terms typically have higher monthly payments but lower overall interest costs, while longer terms result in lower monthly payments but higher overall interest expenses. It is important to understand that the amortization term is not the same as your Mortgage Term.

Mortgage Term:

The Mortgage term refers to the length of time your mortgage contract is in effect. Your mortgage contract is the agreement that you have with the lender. It outlines the contract details like the interest rate, payment amount, and payment dates. The Mortgage Term can range any where from 6 months to 10 years. Your Mortgage term is less than the Amortization Term.

Interest Rates:

Interest rates play a crucial role in determining the cost of your mortgage. The interest rate can be fixed which means the rate stays the same throughout the mortgage term. This allows for predictability when it comes to your mortgage payments. Alternatively, the interest rate can also be variable which means the rate will fluctuate based on market conditions. In a period of decreasing interest rates this can cause your mortgage payments to decrease over the mortgage term. In a period of rising interest rates, this can cause your mortgage payments to increase over the mortgage term. Your credit score, financial history, and the lender’s policies will influence the interest rate you receive. It’s essential to compare rates from different lenders to find the best deal, as even a small difference in interest rates can significantly impact the total cost of your mortgage.

Mortgage Payment Frequency:

Most mortgage payments are made monthly, bi-weekly or even weekly. The more often you make the payments the lower the payment. Also paying your mortgage more frequently can cause you to pay less interest and more borrowed amount (principal) over the life of your mortgage.

Mortgage Payment Amount:

Every mortgage payment consists of two components: principal and interest. The principal is the amount you borrowed from the lender, while the interest is the amount of interest on the borrowed amount. In the early years of your mortgage, a more significant portion of your payment goes toward interest. Over time, your payments will be applied more to the borrowed amount and less to interest. This process is called “amortization.”

Prepayment Terms:

Many mortgage contracts allow for additional payments to be made over the life of the mortgage. Some of these options may include a once-per-year lump sum payment, the ability to increase the regular mortgage payment or to make an additional mortgage payment each year. It is important to know if your mortgage contract allows for a prepayment option. Utilizing the available prepayment option can help to lower the borrowed amount more quickly than just making regular mortgage payments.

Property Taxes:

In addition to the principal and interest, your mortgage payment could include property taxes. Property taxes are assessed by your local government and help fund public services. If you decide to include your property tax payments with your mortgage payment, the lender will collect these taxes on your behalf and pay them when due. It is not a requirement to include your property taxes with your mortgage payment.

Now that we have some of the terminology down, I want to share with you an example to help you better understand how the current rising interest rates have impacted mortgages over the past couple years.

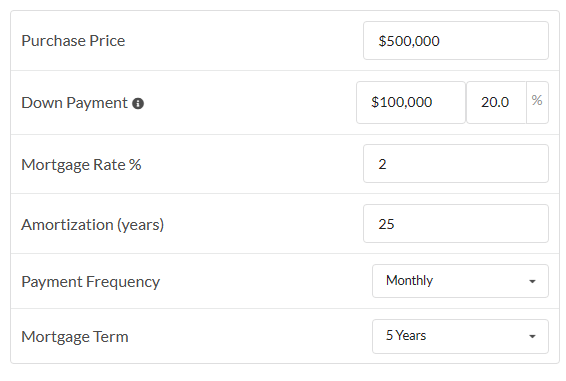

You bought a $500,000 home in 2019 and put 20% as a down payment. Interest rates at that time for a 5 year mortgage term were approximately 2%. Assuming a 25 year Amortization Term. Your monthly payments would be $1,693.80.

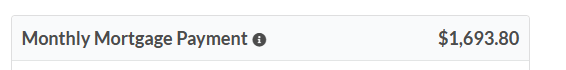

In 2024, your mortgage term would be over and you would be required to renew your mortgage. You now have $335,081 of borrowed money (principal) still owing. Assuming you still want to have your home paid off in 25 years, you now have 20 more years to pay your mortgage. As of right now a 5 year mortgage term contract would have an interest rate of 6%. That means your new mortgage payment is $2,400.62.

As this example shows, the interest rate increasing by 4% increased the monthly amount of the mortgage by $706.82. A monthly increase like this can be a big surprise for many of us, which is why all the discussion in the media right now about mortgage rates.

No mater if you are looking to buy your first home or will find yourself renewing a mortgage with a significantly different interest rate, understanding the pieces of a mortgage and how they fit together is important. Making educated and savvy decisions about your mortgage can help you to ensure you are not blindsided by mortgage renewals and ensure that you paying the least amount possible over the course of your mortgage.

Written by: Jennifer Hare, CPA

If this article has motivated you and you want more information on how to dig into your finances furhter, please feel free to reach out to Jennifer. https://linktr.ee/financecoachjennifer

Leave a Reply