Written by: Jennifer Hare, CPA

For those who drive a vehicle, at what point do you fill your gas tank? Do you identify with the group of people who barely putters up to the gas pump on fumes? Do you fill up regularly on Friday or when your tank is at a specific level? Or maybe getting in the vehicle is always a surprise as to how much is in the tank, and if you can make it to your destination.

Our gas tank habits can be a very close resemblance to how we manage our bank accounts. We may get to the grocery store with a hope that there is enough in the bank account to cover our purchase. Alternatively, we may know exactly how much is in our bank account at any given moment but we don’t know if we have enough to cover our expenses until the next pay day. Maybe we know we have enough for our regular life but what happens if an emergency arises?

While the unknown bank account situation may feel blissful on the surface, I can assure you that somewhere deep within your mind, there is a fear and stress about your money if it remains an unsolved mystery. There is no fool-proof way to guarantee that with a few changes you can continue in life with a financially stress-free existence. Though this is the case, I can assure you that knowing is better than not knowing when it comes to your finances. The concept of knowing what your situation looks like, is the biggest reason it is highly recommended that people regularly and consistently track their household finances.

The purpose behind tracking your expenses is to understand where your money is coming from and where it is going. It really is that simple. Tracking your finances does not need to be complicated, expensive, or time consuming. I will share with you a few ways you can get started with tracking your finances.

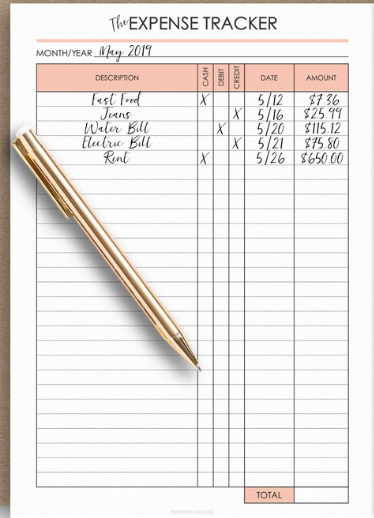

- The Notebook Approach

In order to start tracking your finances, you can purchase an inexpensive notebook that makes it’s home in your purse, car, or beside your computer. Your notebook’s home should be in the place where you spend most of your money, or in a location it will be regularly visible. Each time you make a purchase, write it in the book. Make sure you record the date, the amount, and what the expense was for. At the end of the month, total the expenses and write the sum in the same book by category. Ta-Da you have just successfully tracked your expenses for the month!

- The Excel Approach

Another slightly more complicated method is to use an excel financial tracking spreadsheet. In this method, I would suggest using a pre-made tracking template to save time. (There are loads of templates online. Or, send me a message Ato get a free copy of the spreadsheet I use. I have included my contact information at the bottom of this article.) Similar to the Notebook Approach, each time you make a purchase, you enter the expense into the spreadsheet. The Excel template will total everything for you. In this method as a result of the tracking not being as visible as the Notebook Approach, it is recommended that you set yourself a reminder to enter your expenses on a regular basis. Ideally this would be at least once a week.

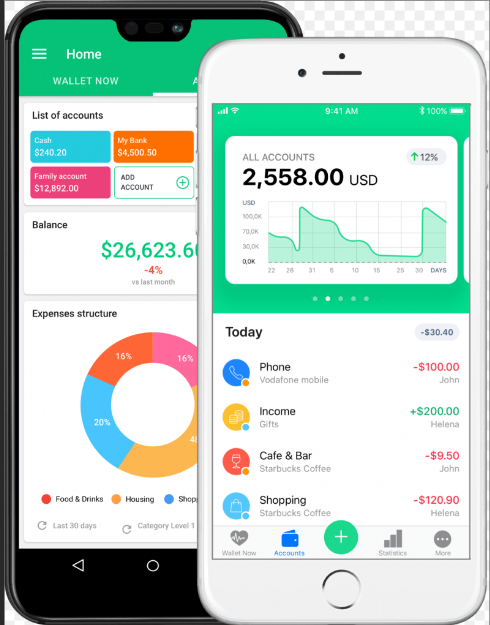

- The Tracking App Approach

A third alternative is to use an expense tracking app. Most of these apps link directly with your bank account. The advantage to this is that there is no need to remember to enter your expense transactions. While this sounds like a very hands-off approach, it is important that you log into the app regularly, as many of the apps need assistance to properly code the expense to the correct category. For example, the app may be smart enough to know that a payment to Hydro One is a Utility Expense but it’s not likely going to know where to code your Walmart purchase for socks. There are several free Apps that are reliable and secure. If this seems like the approach you might like to take, a highly regarded app is called, Mint.

As you can start to see from the descriptions above, tracking your finances does not need to be expensive. In fact, the most expensive version is the Notebook approach, and that will likely only cost you a few dollars. Also, tracking your expenses is only as complicated as you want to make it. You do not need to create massive amounts of categories. In fact, you can start as simple as the following:

- Rent or Mortgage

- Utilities (includes hydro, gas, water, phone & internet)

- Food

- Clothes

- Entertainment (could include eating out, hobbies)

- Savings

- Debt repayment

- Other

So far, expense tracking seems doable for you. It’s inexpensive and not super complicated. But what about the time?

Once you start the process and track on a regular basis (at least once a week), you will find that you aren’t spending more than 15 to 30 minutes, depending on how many purchases you made during the week. Let’s be honest, who can’t find 30 minutes a week to reduce stress and gain understanding about your finances?

Many people avoid filling up their tanks and digging into their finances because it seems too difficult, too expensive, or that it will take too much time. Alternatively, tracking finances can help relieve some financial stress. It can give you a clear picture as to where your money is going. Knowledge can be power. Use a few minutes of your time this week to start tackling your finances and get the power of knowledge on your side!

As was mentioned in this article, I have created a financial tracking spreadsheet that I would be happy to share with you at no cost. Please contact me to get your copy. In addition, I am hosting an Expense Tracking and Budgeting Workshop on April 1st from 1:00pm-3:00pm. If you would like to learn more about this workshop or how you can better your finances, please reach out. I would love to help you make “cents” of your finances.

Jennifer Hare, CPA

E-mail – je*************@***il.com

Facebook – Jennifer Hare, CPA

Instagram – @Financecoachjennifer

2 comments

Heather

Hi, I am interested in a spread sheet and your workshop

Rachel

Hi Heather,

That’s great! I have sent your email to Jennifer. She’ll be in contact with you shortly!