If you want to win at something, you have to have goals! What do you want in life? What are you fighting for? Do you have dreams? Hold onto hope and fight with grit!

I read a quote on Pinterest by Journeystrength that said,

This has been a motivator for me on the quest we began to pay off our mortgage so as to owe no one anything!

Long story short, we wanted to be free. We were tired of so many bills and not being able to reach the dreams we had in life. At this point, we only had our mortgage left in actual debt, which we are both very grateful for!

However, we live in an old house that needs a lot of renovations, we have family that lives far away, and we desire to have kids someday (which haven’t been able to come by natural causes). So, the dreams are there, but unreachable. So, we needed a goal.

The goal became to pay off our house as quickly as possible. We got focused. We worked extra hours, had a yard sale, and got creative on how to save on our other bills and expenses. Our mortgage renewal is due February, 2021, so we set a “God sized goal” to have the house paid off by then. We started in the summer of 2017 with $105,000 owing. It was a huge goal with the amount of income we were bringing in, but we thought we would give it our all.

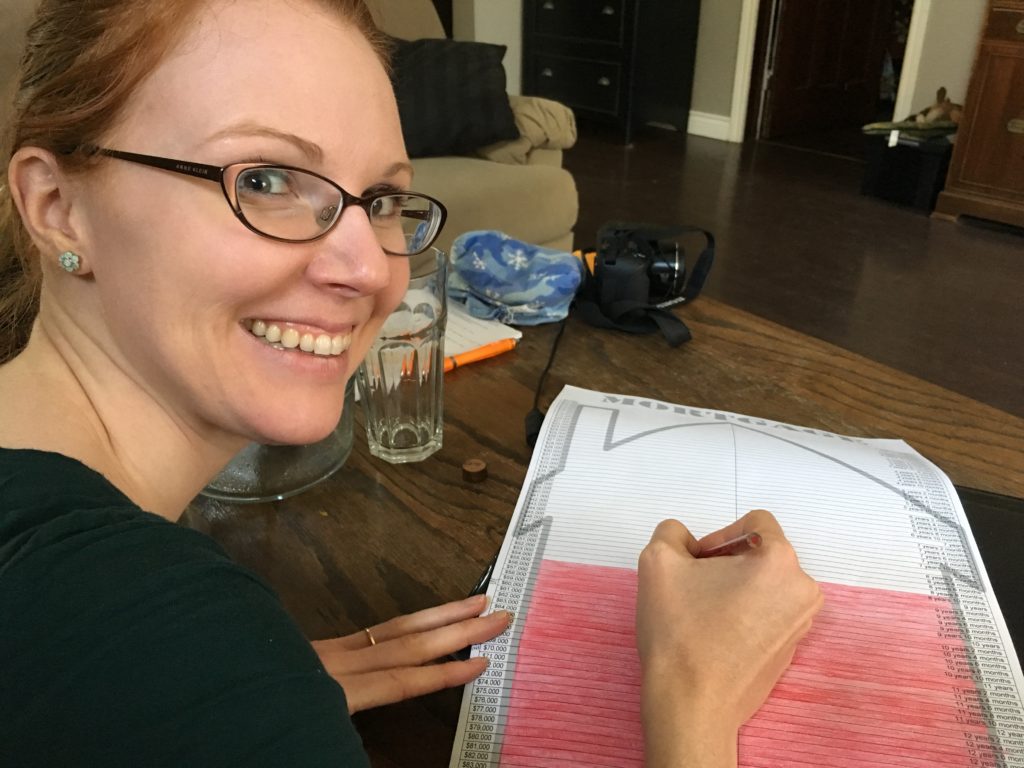

Then we had to figure out what steps we were going to take to achieve the goal. It felt good to pay off what we could bit by bit, but I was struggling. We had already paid off $20,000, but It seemed like it was taking a really long time and that we were making very little progress. I am a visual person, so I decided to make a chart with an outline of a house. I wanted a number on the chart that was fairly achievable to frequently reach, so I put $1,000 markers going up the page on one side with a rough estimate of years left owing on the other side if we just did the regular payments. I couldn’t fit the entire amount from $105,000 to $0 on the chart, so I started it where we were currently at, which was $85,000. We hung it on the side of the fridge as a daily reminder. Michael and I would have ‘colouring dates’ every time we paid another $1,000 on our mortgage. Colouring in another line felt satisfying. We were watching the chart come to life with colour. Though it was still moving slowly, it was a great motivator to keep us going strong. It showed us the results of our efforts.

We decided that our plan was going to consist of paying $1,000 per month above our regular mortgage payments. Some months have been tighter than others due to varying circumstances, like our car breaking down, our dog needing vet attention, or job loss. On those months it has been hard to stay motivated. It can get frustrating when a few months worth of issues keeps building and taking away from your progress. However, other months have been accelerated by added income, bonuses, and gifts. This returns the excitement and keeps us pushing through, especially when we can colour two or three lines because of it! It’s funny how that works. One month you’re scraping change to make a dent, and the next you’ve got overflow to really make a difference. It’s in the tough times that you have to remember that the added expenses will ease up and you’ll get back on track. DON’T GIVE UP!

Find other people with similar dreams or goals. You need that accountability and encouragement to keep you motivated. Cheer each other on and find ways to help one another when you can. Have meals together; find cheap or free activities to do together. Make charts and compare notes. Do whatever you can, because in the end, you’ll be able to celebrate together as well!

Even though getting out of debt is really hard work in so many ways, it is worth it! Putting your dreams, goals, and plans into action can indeed become reality. We are still working hard at paying off our mortgage. The goal to achieve is still ‘God sized’ in our minds; however, we know that it is possible. Our dreams are too important to us to give up. Begin to dream, set a goal, make a plan, and put it into action. Your hard work and determination will bring it into reality!