You feel the panic rise up as the phone rings. You’re afraid to answer it. What if it’s the creditors again? But, if you don’t answer, what if they won’t stop calling? …Could it be someone else? What if there’s an emergency or someone needs me and I’m missing an important call?

It was a rough time for my family. My parents were recently divorced, my brother had moved away to college, and all of our finances were in a tight place. Divorce, schooling, utility bills, and mortgage payments, just about choked us. My brother was having issues with his phone company and had an unexplained charge. They sent his bill to a credit collection company and they would call, harassing and threatening us on a daily basis. It was in the day when cell phones were just starting and we didn’t have caller ID on our landline. They would yell and threaten to take over our paychecks until they got the money. This would, of course destroy our credit.

My dad was doing everything he could to stay on top of the other expenses and my brother was away at college without a job. I was in between schooling, working at a fast food restaurant trying to save up for college. However, I tried to help out with groceries and some of the basic expenses where I could.

I remember feeling crippled by it all. I remember feeling the fear of losing everything. Yes, it was only one creditor for the one bill, but I knew that the rest of our finances weren’t good either. I knew that if we missed other payments, there would probably be more creditors calling, or worse knocking on our door. What would happen? Would we lose the house and everything we had? How was I going to get ahead and start my own life if my dad or I couldn’t gain any ground financially? Could I handle life dealing with the divorce and changes to my future on top of all this financial mess?

I avoided the phone like the plague during that time! We made the payments for everything as best we could. We prayed, we worked hard, we were frugal, and eventually we came out ahead. Someone generously helped us along the way as well.

Because I couldn’t get ahead very much financially for school, I ended up taking out a line of credit for a program that I wouldn’t finish. I accumulated debt myself and then regretfully had to pay it off bit by bit, which took years. I remember the Program Coordinator at the school telling us to not bother working part-time or we would fail the course. Having a high sense of responsibility, I listened. But, since I only really had enough money to pay for my tuition, I started putting everything on my line of credit. I had to get a car for school as mine died. The school was 40 minutes from my parents’ house, so I had gas expenses. I had to buy books and equipment for my program…it all went on the line of credit, until before I knew it, I maxed it out.

Again, I fell into the mindset that I could pay it little by little. I felt the weight of being ‘chained’ to the debt, but I figured I couldn’t really do anything anyways, so I made the minimum payments. It wasn’t until I wanted to go to school again to go into full-time vocational missions, that I realized the true weight of it. I wouldn’t be able to start missions until all the debt was gone. I worked 60 hours+ per week one summer to save up for school and to pay down the debt as fast and as best I could. My Dad and Stepmom, now in a much better financial situation, let me live with them for free during this time, for which I am very grateful!

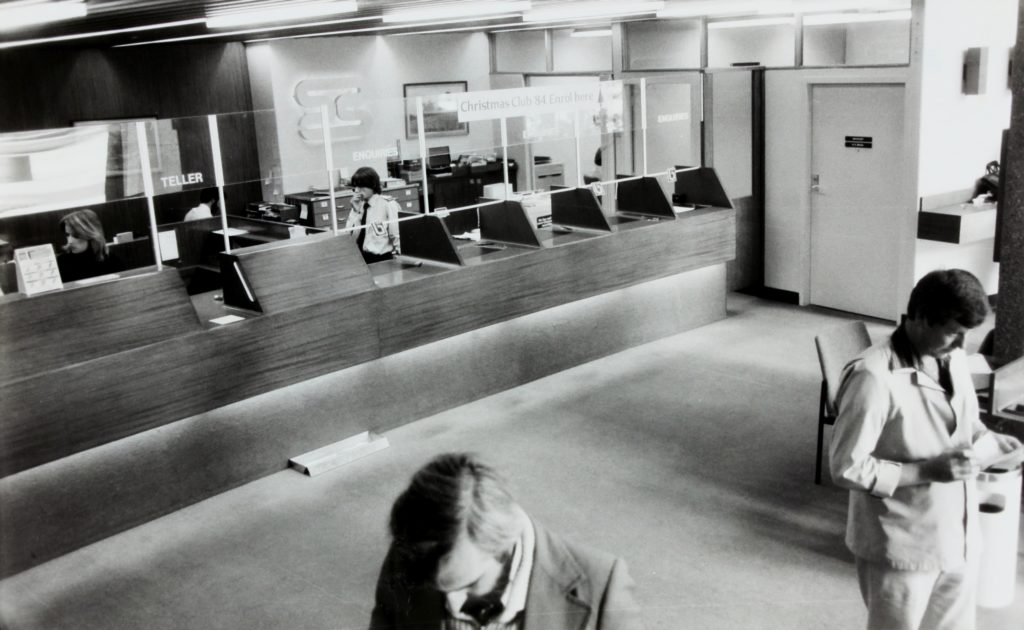

I remember going into the bank one day to make another payment on my loan. I only had about $3,000 left to go. The teller told me there was nothing left owing on the account. I said, “That’s not possible! I had this much left the last time I was in”. I had the statement in my hand to pay the bill showing the difference left owing. She said, “Well, it looks like someone made the payment to clear the account because your balance is $0”.

I was left dumbfounded! I couldn’t believe it! I called the people I suspected and sobbed when it was confirmed what they had done for me. To say I was extremely grateful feels like an understatement! I felt the weight of the debt fall off and freedom and relief washed over me! I promised myself at that point that I would never go into debt again. I still used a credit card, but faithfully paid it off. I still remember that day and that feeling, and know that I will never forget it. That whole season of life was a well-taught lesson for me.

I know this isn’t everyone’s case. Getting out of debt does take A LOT of really hard work. It takes day-by-day accountability and progress. It means working one, two, or three jobs to get by. It means stopping all enjoyable, additional expenses until you can get your finances under control. It is hard and grueling at times, BUT it is so rewarding! The harder you work, the more victories you see, the more it energizes you to get ahead.

It becomes like a game of beating the debt instead of it beating you.

You can have victory! Even if creditors are calling you, make a plan. Keep paying off the minimum allotted payments until you can begin to save up. As Dave Ramsey teaches, a buffer fund of roughly $1,000 in savings is good. This will help to kick ‘Murphy’ (Murphy’s Law) out. Once you can take care of the basic necessities, take whatever money you have left and dump it into the smallest debt you’ve got. Pay it off and feel the victory of that success. Now roll the money you used in paying off the first debt, and apply that payment as well to pay down the next smallest debt. This will help you to gain traction and be able to pay off all of the debts much faster. It will help you to stay focused. You will feel incredible relief. You can do this! The creditors will want all of your money up front, but keep doing what you can and paying what you can. At least they’re getting something from you.

Even when your finances look grim and you’re overwhelmed by the weight of everything, know that there is hope and you can get ahead. We’ll do it together one step at a time.