Written By: Jennifer Hare, CPA

Do you plan how to spend your money?

Have you ever found yourself in a situation with a limited amount of resources? Maybe you work in a job where you get a set amount of vacation each year. Often people will spend countless hours trying to figure out the way to maximize this vacation time. This planning for some might include a spreadsheet or a calendar to ensure they are wisely spending their allotted vacation time. If you identify with this scenario, let me ask you, do you spend as much time carefully planning the use of your financial resources? Most people are willing to plan out their time but when it comes to our finances people tend to freeze. Maybe planning out your financial resources feels scarier than planning out vacation time. I am here to tell you that planning out your finances, also known as budgeting, is one of the greatest gifts you can give yourself.

Why do people often find budgeting their finances so difficult? One reason is that many of us were never taught how to budget. In school many of us were taught how to allocate our time by having assignment due dates. Between extracurricular activities, part-time jobs, and social events, we still needed to find time to complete our school work by the deadline. Many of us never had access to a course that showed us how to budget our money and there weren’t any other teaching opportunities presented either. Another reason that we find budgeting our finances so difficult is that there is no instant reward to budgeting. When we plan our vacation time, we get the instant or relatively soon reward of taking time away from work. When we plan our spending, we don’t often get a reward of more money to spend. Sometimes it is even the opposite result and we need to slow our spending in certain areas. Working on your finances may not yield tangible results for several months or even years. We often get bored and give up long before we see results.

Now that we know some of the reasons why we avoid budgeting our finances, how do we move forward? First of all, please understand that budgeting your finances does not need to be difficult. It can actually be quite simple. To start budgeting all you need is a notebook or an Excel spreadsheet. Then follow these steps:

- Decide what month you are budgeting for. We often budget on a monthly basis as most expenses are paid on a monthly basis.

- Income: Write down your expected income for the month. For many people, we know how much we are getting paid and when. Make sure to look at how many pays you are getting this month to help determine your total income.

- Expenses: Write all the types of expenses you expect to incur this month. Here are some ideas: Rent/Mortgage, Utilities, Groceries, Cell phone, Insurance, Vehicle payments etc. This list of expenses can be as detailed as you would like to make it. Then you are going to budget these expenses in three ways

- Recurring Monthly Expenses: Typically, we know how much we pay for rent, cell phone, insurance, debt repayment, monthly savings, car payments, and any other expense you have that is on a fixed contract. You can add these amounts to the expense at the amount the contract says they are.

- Regular Monthly Expenses: These items will include utilities, groceries and any other expense that we have each month but can fluctuate based on how much we are using. These amounts can be a little trickier to determine because they change each month. A good rule of thumb for these items is to take an average of the last three months of actual expenses. If you have been tracking your expenses for a long enough time, you can look back to what you paid last year as sometimes the expenses can change based on the season we are in. For example, we tend to use more hydro in the summer when we are running our air conditioners and more gas in the winter when we are using our furnaces.

- Other Expenses: These are the ones that you do not necessarily encounter on a regular basis. This could include items like eating out, buying clothes, entertainment, or vacation spending. Again, to determine these amounts you can look at what you spent previously on these items or you can look at what you know you are planning to spend. An example is in the month of your best friend’s birthday, you may know that you want to spend $50 on a birthday gift for your friend.

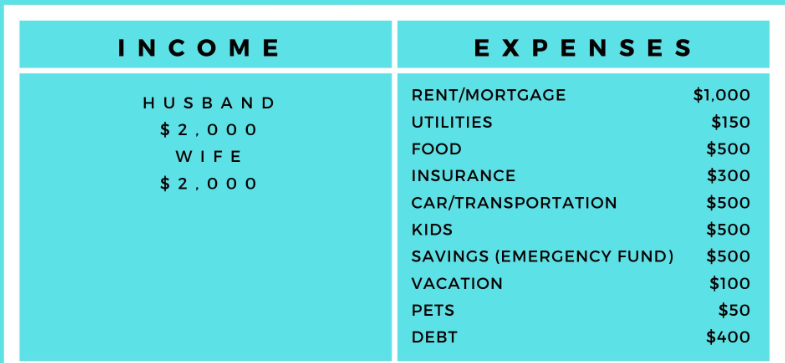

When you have all of that done it will look something like this:

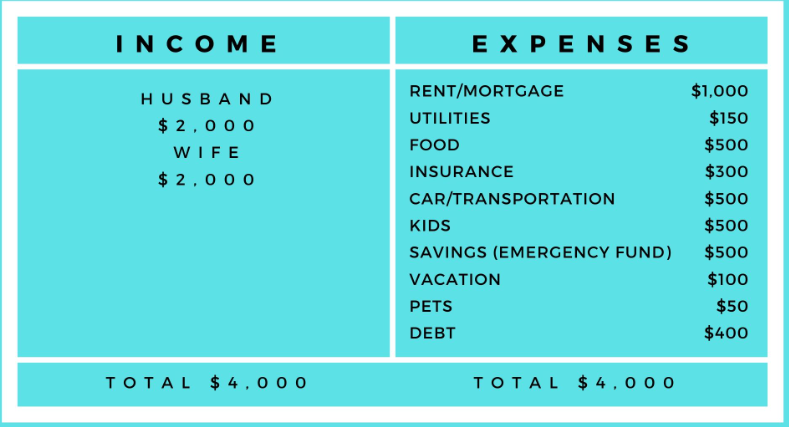

Now we have all the income we expect to earn and all the money we plan to spend. You are going to total up your income, and total up your expenses. Then you will take the total income minus the total expenses. The goal is to have enough income to cover your expenses AND have all your income allocated to an expense type. Something like this:

If your total income is greater than your total expenses, this means you do not have a job for all the money you are making. When your income doesn’t have a job, we often tend to buy things we don’t need or spend frivolously. If you find yourself in a situation like this, consider your long-term financial goals. Maybe you can donate some of your extra funds or beef up your emergency savings account.

If your total expenses are greater than your total income, this means that you are planning on spending more money than you have coming in. If you find yourself in this situation, nothing has gone wrong…yet. You can look at your planned expenses and change your plan. Maybe you are not going to spend as much on your friend’s birthday gift. Maybe you will look for more affordable meal options for the month. Don’t be defeated if you find yourself in the situation of extra expenses, and don’t throw the budget away! When the budget shows more expenses than income you now have an opportunity to make changes to your spending before you find yourself at the end of the month with no money and more debt.

I want to leave you with a reminder that this is just a plan. Life will happen. This doesn’t mean you should continue to ignore budgeting. Budgeting is a very helpful tool that can help you maximize the money you have by allowing you to carefully plan how to spend your money. It also can help you to better enjoy your money. By setting a budget you get to decide how to spend the money you earned and that is where the magic of budgeting happens!

If this article has intrigued you and you want more information on all things budgeting, please feel free to reach out to Jennifer. She can be found on Facebook at Jennifer Hare, CPA and on Instagram at Financecoachjennifer or through e-mail at je*************@***il.com.