One of your first thoughts about Christmas every year is presents. Stores help you think about it months in advance. Is it just me or have stores prepared even earlier this year?

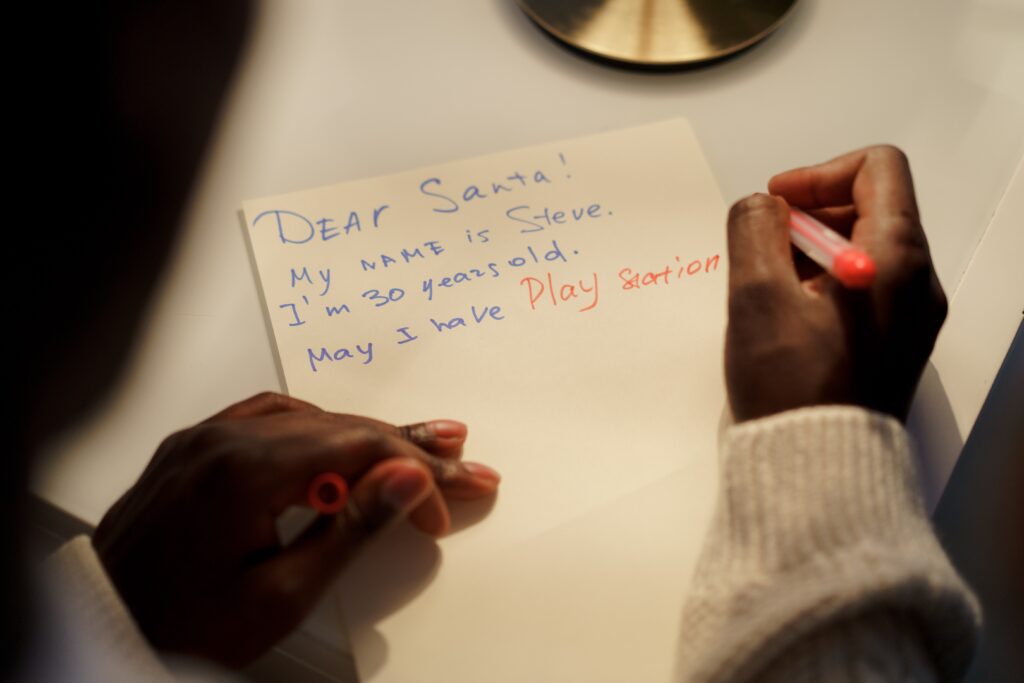

Anyways, if you’re like me, the little kid comes out in you as you excitedly think about what you would like to receive from others this holiday. If you’re like me, it’s all stuff you’ve looked at throughout the year, but didn’t want to spend the money on it because other priorities took precedence. It’s the one time of year to let loose and ask away.

I’m typically a very budget-conscious person, if you haven’t noticed from all of my finance posts! But, when it comes to Christmas, the sky suddenly becomes the limit for me, in asking for more expensive gifts and in buying them for others too. The spirit of generosity pours out and the child-like hope of getting great gifts continues.

But is that fair to my loved ones?

Relatives and friends often don’t like to say what their budgets are for Christmas gifts. Financial conversations are quite private even among families. So, to avoid over-extending their limits, give them a variety of items at various price-points you’re interested in.

For example, I love learning! So, I always try to have books on my Christmas list. They are inexpensive, a great learning tool, and are an enjoyable form of entertainment. (Insert my shameless plug to buy our book, Sustaining Hope, for someone on your list this year!)

I also enjoy spa treatments like massages and pedicures, household items, gifts cards to restaurants, money towards a course, stationary (Another shameless plug – get your journals and notebooks here!), watches, workout stuff, etc. These can all range from inexpensive to a decent dollar value.

I give a variety of choices so that my loved ones can decide on their own what they can afford without breaking their budget. They can also feel good about what they bought because they know I’m interested in it.

Christmas can get extremely expensive if you’re not careful! There’s family, relatives, and friend gifts. There’s White Elephant exchanges. You might buy gifts for coworkers, sports teammates, neighbours, etc. Charities usually use this time to ask for help with supplies and extra donations. If you’re not paying attention to how much your spending, you might be surprised by Christmas to see that your credit cards are maxed out or you’ve spent your whole paycheck and now can’t pay your bills. Don’t give yourself the consequence of having to pay off your credit card bill for the rest of the year from one binge-shopping experience in the name of Christmas. It’s not worth it.

Look at your income and expenses. How much would you like to spend on Christmas gifts for everyone? Can you afford it without compromising on your priority expenses like rent, car maintenance, food, etc.? Put that list on your phone home screen or in your wallet so you can easily see it while shopping; then stick to it. Choose gifts for your people that stay within that price range you’ve set. Don’t feel guilty that you’re not buying the world for them.

There’ll suddenly be lots of things jump out to you that remind you of that person while shopping. Resist the urge to buy the extras. Stick to the list.

If you find people give you a list with items out of your budget, don’t be afraid to go back to them and ask for some less expensive options as well, “For variety’s sake.” If they still don’t get it, tell them your budget doesn’t allow you to spend that much this year, so they can either give you some ideas or you’ll get creative. They’ll most likely come up with something at that point!

The reality is that when it comes to Christmas, we all have a tendency to throw caution to the wind and forget the value of a hard dollar earned. Children especially don’t understand this. This season provides an excellent opportunity to teach kids about the value of work and money, and that Christmas isn’t just about presents. Find ways to make Christmas fun without it being entirely centered around their presents.

Enjoy this Christmas in a financially safe position instead of feeling worry and regret about how you’re going to pay for everything.